Obviously I’m not the only one that has noticed the bubbleistic traits of cryptocurrencies. Clients have been asking my opinion too. So here goes.

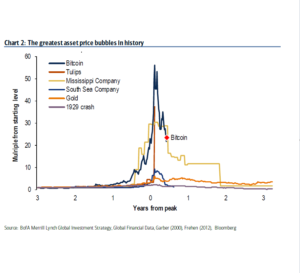

The Bitcoin cryptocurrency is tracking the downfalls of the other legendary asset-price bubbles in history. In less than one year since its record high. This is what Bank of America Chief Investment Strategist Michael Hartnett wrote to his investors on Sunday.

I’ve written before about the dangers of the more-or-less average (yet affluent) retail investor participating in this market. Average meaning less than, say, a few million in investable assets.

The cryptocurrency has fallen more than 65 percent since peaking in December at $19,511. At the very moment this is being written and posted, Bitcoin USD is up 1.55% to $6,945.64 on Wednesday April 11. Trading is undoubtedly being affected by short term geopolitical considerations.

Here’s the chart published by BOA and Bloomberg. Note the comparison to the classic bubbles of history.

I will discuss the validity of technical analysis and chartism at another time. Just know that technical analysis is generally looked down upon in academia. Not that everything that comes out of academic research is valid either.

So what does all this have to do with planning for risk and investment decision making?

Most people like to think that they are stable decision-makers. That attitude toward risk are intrinsically part of a person’s personality. A person may describe themselves as hotheaded and impetuous, extremely cautious or somewhere in between. But most people think of themselves as being consistently one way or another and without vacillation.

That view is not held up by research. Risk-taking decision-making is as much influenced by situations as traits. Behavioral economics pioneers Daniel Kahneman (Nobel Prize winner) and Amos Tversky, among other researchers, write that risk preferences and behaviors shift radically depending on a multitude of factors. This includes how social environment and pressure, resources available, and how a risk-taking decision is described to the decision maker.

Also is the fact that this type of asset is new and the trading market is not fully developed. More on that in my next post.

While I do believe that cryptocurrencies and especially block chain technology is here to stay, and will eventually serve a useful and important purpose in our economy – there will be severe growing pains. We are being pained right now.

This is the way new technologies behave, we are in the early adopter – bleeding edge stage. Very few will do well. Most that participate now will suffer. So it’s caveat emptor.