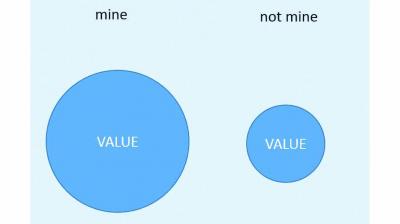

What is a very common issue that business valuators come across? It’s that most people overvalue the things they already own.

In valuing companies for buy/sell or acquisition purposes, it is extremely likely that the owner (seller) will place a higher value on the business than the buyer.

This is called the endowment effect by psychologists and behavioral economists.

This is so common in the M&A world that intermediaries just expect this to occur. It’s an automatic.

Why is this? Behavioral economists have researched and written about the many ways human behavior deviates from standard economic theory.

Standard economic theory states that individual actors always act rationally and in their own best interests. But recently economists have questioned whether that is true.

Recent research demonstrates that people’s decisions are not always rational. Rather, they are often influenced by emotions and cognitive blind spots.

The endowment effect was identified by Richard Thaler about fifty years ago. He used the example of a person who bought some bottles of wine for five dollars each. A short time later, he refused to sell the wine back to the seller at $100 a bottle. Despite the huge profit.

Richard Thaler (along with the psychologists Daniel Kahneman and Jack Knetsch) conducted and published in academic journals research on the endowment effect. It would take a long post to report the details of their work but in summary, the results showed that sellers much overvalued the items they already possessed. Even for small items such as a university mug.

Behavioral economists believe that sellers are naturally loss-averse. People place more importance on losses – such as giving something away – than on gains. The pain of losing something is greater than the pleasure derived from gaining the same item.

Even more irrationally, recent research suggests that ownership of an item creates a psychological attachment between that item and a person’s identity. No matter how small the item. See the work by Sara Loughran Dommer and Vanitha Swarminathan in 2012 for an example.

To put it simply, the owner of an item may have a difficult time selling something once they feel it’s a part of their identity. They feel the pain.

The next time you are working with a business owner in the process of selling their company or are the business owner-seller yourself, it’s probably a good idea to consider this cognitive bias.